Most Chief Financial Officers are under time pressure – having to do more with less. Not only does the CFO have to ensure the controls over transaction processing are in place and the reporting ticks over like clockwork, but he/she also has to provide financial insight and significantly contribute to the Executive team.

The CFO is expected to facilitate the creation of a relevant and flexible plan which provides direction and improves business performance. With increasing uncertainty, business ambiguity, and environmental turbulence, there are great difficulties understanding what the future holds and how we should respond to various factors such as climate change, the COVID-19 pandemic, and trading partners. Some industries benefit and others are severely impacted. But all businesses need to develop a plan to be “future-ready”.

The desire is for the CFO is to have more time and control, less stress, improved decision making, better business alignment, and a forward-looking approach. The CFO needs to have a seat at the decision-making table and to be relevant to the CEO’s strategic thinking. The old response of a CFO to guess that next year’s revenue will be last year plus inflation plus 5% for growth are no longer good enough. Knocking up an Excel spreadsheet over the weekend with a bit of hope and ambition embedded in the formulae has become inadequate.

Some answers which many have tried, include:

High performing CFOs, who have a seat at the decision-making table, approach planning in a manner that is consistent with and contributes to the CEO’s strategic thinking and objectives. They are expected to facilitate relevant and flexible plans, to provide direction and improve business performance. How to deal with radical uncertainty is therefore a constant challenge.

Models and frameworks do exist, which the CFO can utilise, to accommodate extreme environmental unpredictability such as climate change, COVID-19, trading partners and other factors.

These models and frameworks can be best understood by taking into account the six non-negotiable lenses which will give rise to better, more strategic, ‘future-ready’ planning and decision making.

In Australia, most businesses use a fixed 12-month period for the budget which usually finishes on 30 June, occasionally 31 December. The right time for a plan horizon should usually be determined by decision making lead times – and so will vary between and within businesses. The Capex budget for a mining company could be 5 plus years. The longest lead time for a new product could be 12-24 months. So the plan horizon should be at least 12 months. StatOil in Norway operates an exploration business with long lead times, a retail business with short lead times and a refinery business which has lead times somewhere in between.

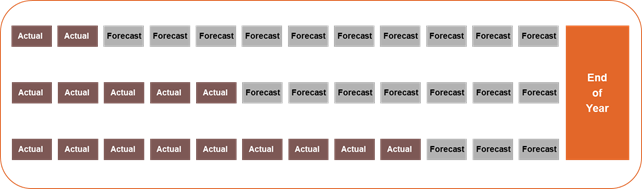

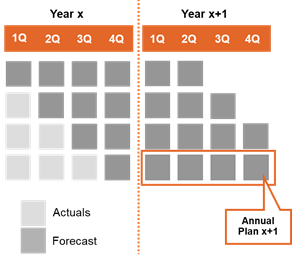

So, this and other recent international trends seem to confirm that effective businesses today need to operate with a horizon greater than 12 months. This requires the adoption of a rolling forecast where the horizon rolls forward such that there is always a consistent level of visibility.

The conventional approach of 12 months fixed to 30 June determines that the length of the horizon will vary depending on the point of time during the year. Using a car-driving analogy, during the budgeting cycle we shine a strong light into the future, then we “turn off the high beams” and start driving into next year with low beams only. At the beginning of the year our lights illuminate all four quarters ahead. As we drive on and the quarters pass, the low beams gradually get covered in mud and become weaker and weaker… but we do not mind as long as we can see until year-end…Is this a safe way of driving in the dark?”

The following diagram illustrates this diminishing visibility of the future time after the wall of 30 June is reached.

A driver-based rolling forecast is a management tool that enables a continuous planning process unencumbered by fiscal accounting periods.

The focus for this tool is the ongoing planning for the revenue required to maintain/grow profit margins, and the resources required for optimal capital investment – ie continuous “keep the lights on” work.

This continuous planning process immediately reflects known changes in sales, capital requirements, deteriorating delivery infrastructure, economic conditions, external forces and/or anything else that will affect the future physical and financial condition of the company.

Most businesses who have adopted rolling forecasts operate with a horizon that is longer than a year. Amex uses five quarters; Unilever Canada uses 18 months. This might not sound like a big change, but in fact, an 18-month rolling forecast, updated every quarter, can increase visibility by a factor of 3 over 1 within a fixed annual period.

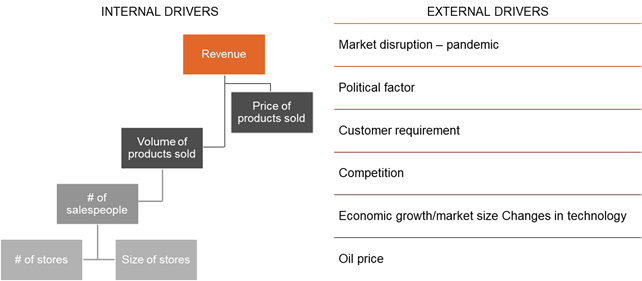

The revenue element of the budget process is the hardest to forecast, as it is the most turbulent. Often the business drivers and the business model are not well known by those who are entrusted with preparing revenue projections. However, trying to ensure such projections are as accurate as possible is vital, as revenue drives the rest of the business.

Typically, when formulating the budget, the management team is comfortable with the expenses area of the forecast. This is reflected in the level of detail, most of which is historically based. Yet when looking at forecast accuracy, it is the revenue which has the greatest impact, both positively or negatively on the result. The level of revenue-related detail is often only a few lines, which reflects how poorly the causality of revenue is known or can be easily controlled.

Driver-based forecasting focuses first on planning for the work that drives the economics of the business, such as:

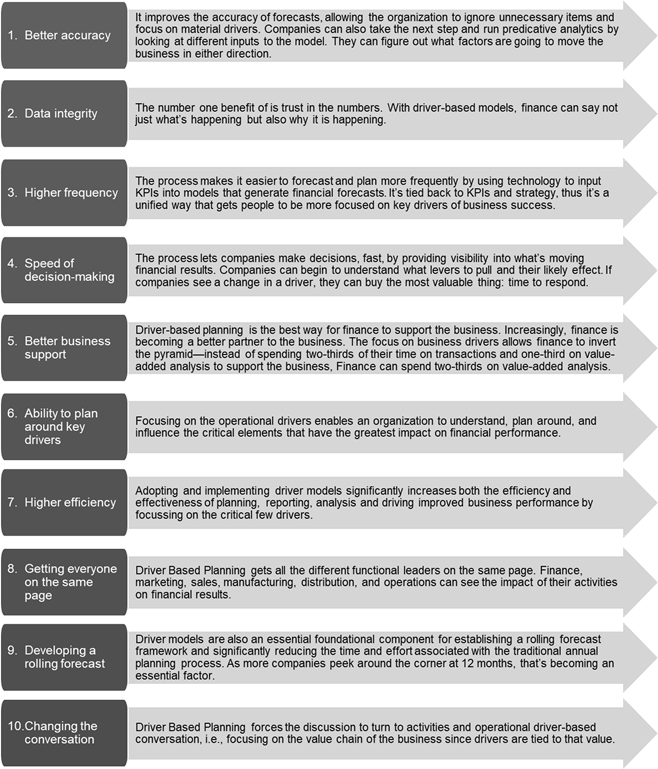

The key benefits of Driver-Based Planning are:

The key steps in getting ready for Driver-Based Planning are:

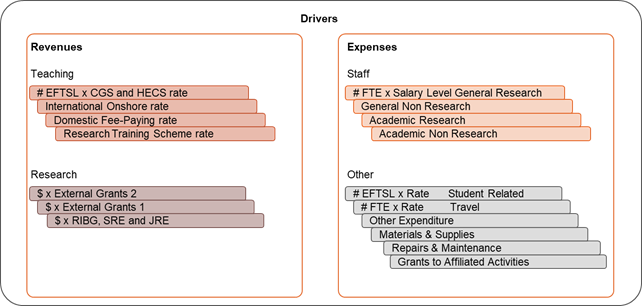

Case Study: For a major university we looked at the major drivers, which for revenue were student enrolments (by degree type, under and post-graduate by subject area), and for costs were staffing numbers (staff rates by position and level). By factoring these drivers in we were able to develop the following financial forecasting models.

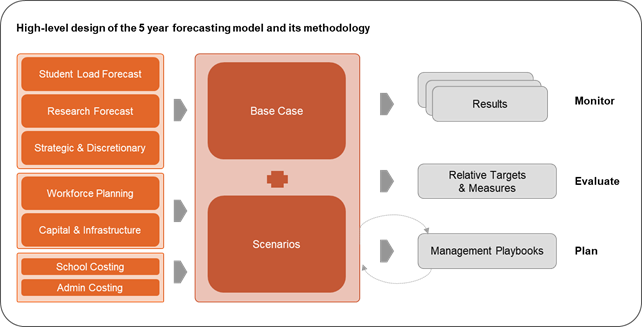

Faculties and Schools are responsible for carrying out the day-to-day teaching and research operations of the university. As such, they are in the best position to understand the detail of their operational drivers. The design of the University’s 5-year forecasting model is depicted below:

Model Design – Inputs (Drivers): Focusing on the key drivers of the university will enable the Finance team to formulate the forecasts quickly, with more time available to spend on analysing, rather than collecting data. Assumptions and rates should be pre-determined to ensure consistency across the university and ease of collection.

All of the major banks in Australia use 5-year financial models to project their P&Ls and Balance Sheets. They are trying to address their interest rate risk (i.e., how their products change in terms of rates and volumes based on changes in the underlying market interest rates.) They have sophisticated software, measures, and risk appetite targets with formal decision-making processes driven by a powerful ALCO (Asset/ Liability Committee). The goal is to understand the nature of risk under different situations and to address strategies to mitigate the risk.

Case Study: For a major University we developed a base case and financial management plan and budget and then added on scenarios for changes in research funding and student enrolments.

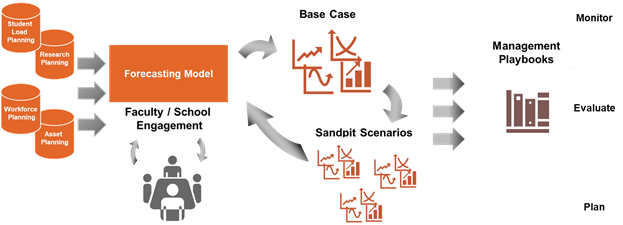

Business confidence comes when a forecasting model is transparent and inclusive. Accordingly, getting participation from all relevant parties was vital to the forecasting process. Once the base case was developed, sandpit scenario modelling led to the development of management playbooks. Various forecast scenarios assisted in developing budgets and forecasting plans to help the University shape a different future, thereby enabling the organisation to become ‘future ready’.

This led to the development of a range of management playbooks that addressed changing student numbers by +/- 10% and changing research by +/- 10%. This process (which is depicted below) resulted in the following significant improvements:

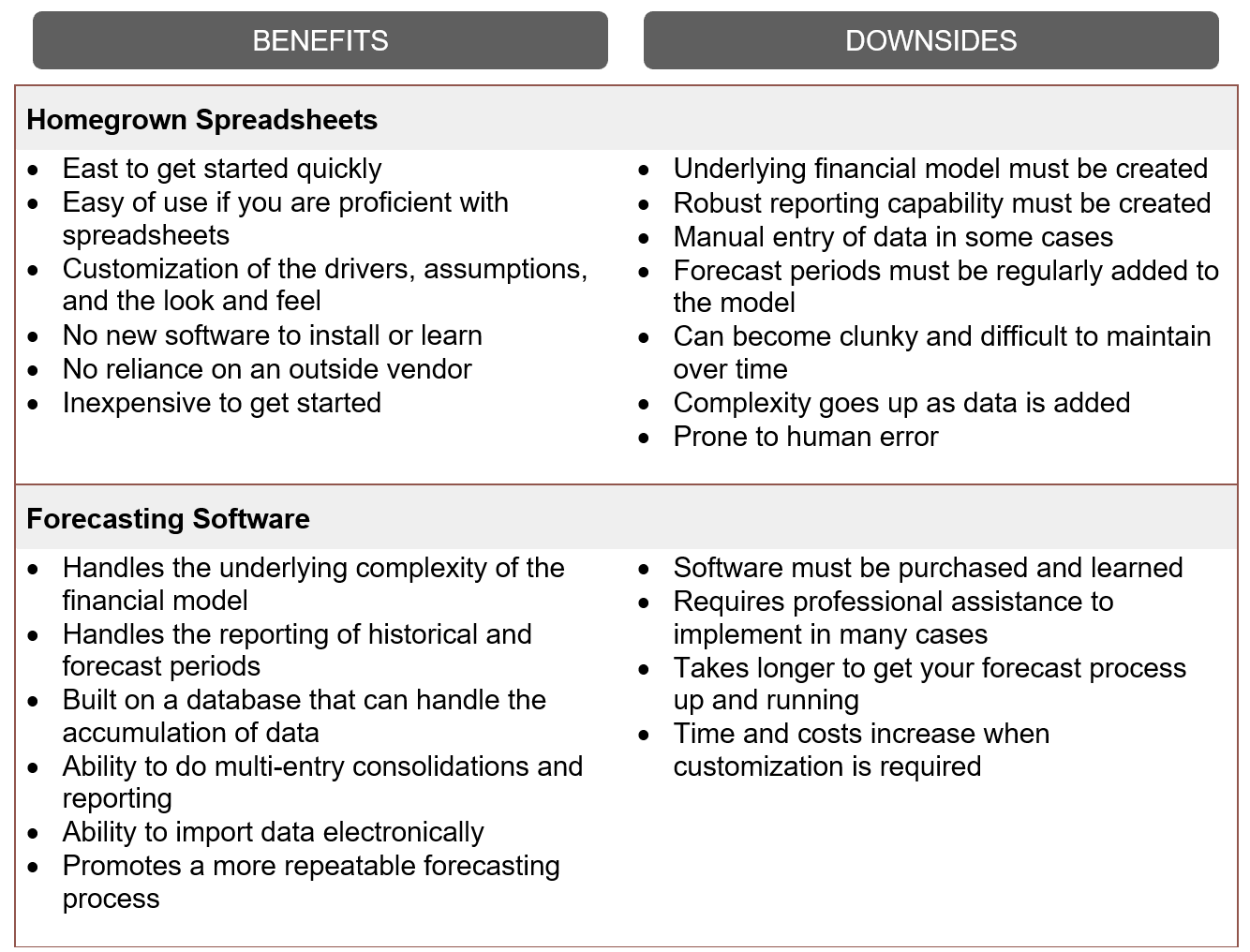

Most financial models are developed using Excel. However there are many limitations to spreadsheets which are improved by using specialist budgeting and planning software.

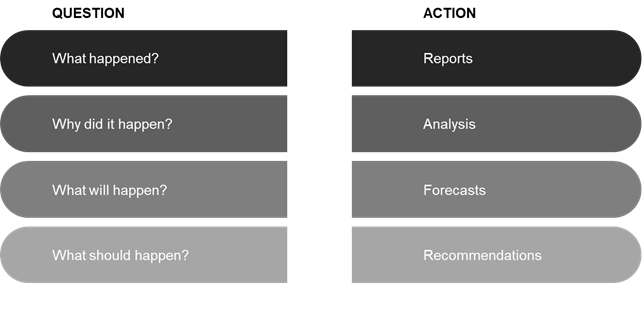

The Planning team should lead a process to make better smarter decisions. As well as producing an information pack which includes the financial results and future plans, the finance team should identify options, make recommendations and lead a discussion to support the Executive Leadership Team to make smarter plans. The Finance Team needs to help facilitate answers to these questions and to then clearly and consistently communicate these to all relevant parties.

The big opportunity for the ‘modern’ CFO is to not only gain more time in the planning process, but to also be more relevant to and an integral component of the Executive’s strategic planning and decision-making functions.

The key message is that while CFOs cannot 100% accurately forecast the future for both them and their organisation, with ‘good enough’ foresight, wise preparation, and timely action, they can significantly contribute to making their organisation’s future direction and desired performance levels much more predictable. The best analogy is for the CFO to be more aligned with the navigator of a sailing ship, rather than a fortune teller.

Centium’s Director Financial Management Consulting (Grahame Scriven) has many years’ experience in the Financial Services, Commercial, Government and Education sectors. He has lived through the transition stages of the ‘modern’ CFO and has personally implemented many of the strategies referred to above.

If you would like to have a confidential and obligation-free discussion, please email or call Grahame Scriven on grahame.scriven@centium.com.au or 0422 773 352 or contact us to arrange a 1-hour Teams meeting or else an in-person consultation to address your business challenges and how Centium can help. Browse additional information about Centium's Financial Management Consulting services.